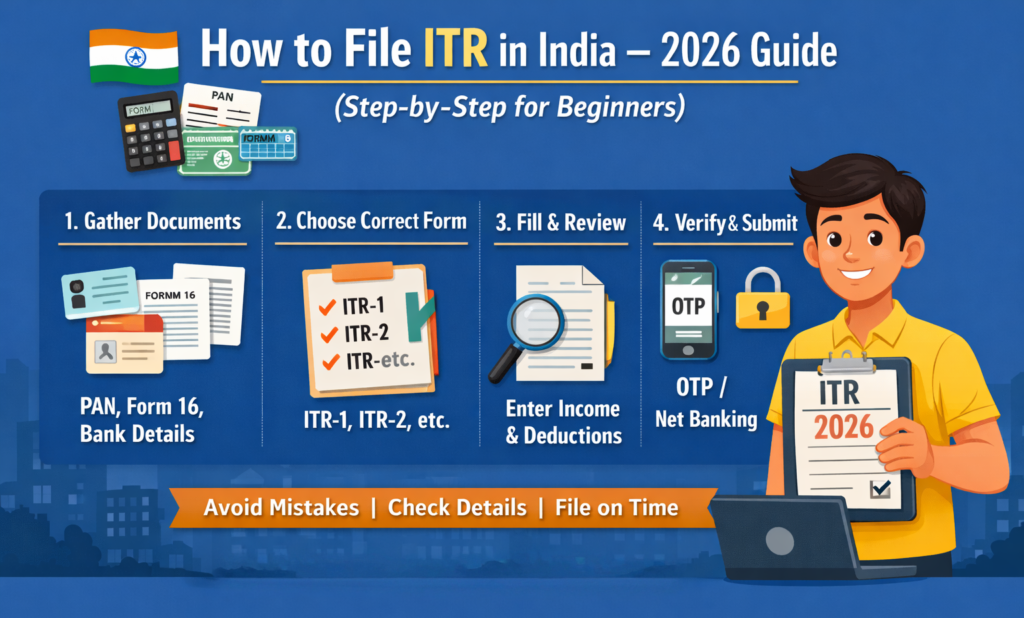

How to File ITR in India – 2026 Guide (Step-by-Step for Beginners)

- How to File ITR in India – 2026 Guide (Step-by-Step for Beginners)

- 1. What is ITR (Income Tax Return)?

- 2. Who Should File ITR in 2026?

- 3. New ITR Filing Rules for FY 2025–26 (AY 2026–27)

- 4. Documents Required to File ITR in 2026

- 5. Types of ITR Forms (2026)

- 6. Step-by-Step Guide to File ITR Online in 2026

- 7. Common Mistakes to Avoid While Filing ITR

- 8. ITR Filing Due Dates for 2026

- 9. Benefits of Filing ITR Every Year

- 10. Why File ITR with a CA?

- Conclusion

1. What is ITR (Income Tax Return)?

An Income Tax Return (ITR) is a form in which taxpayers report:

- their income,

- tax deductions,

- tax liability,

- and refunds (if applicable)

to the Income Tax Department of India.

Every individual, business, or company earning income must file an ITR before the due date.

Filing ITR also helps in getting loans, visas, and financial approvals.

2. Who Should File ITR in 2026?

You must file ITR if:

Your total income exceeds ₹2,50,000 (basic exemption limit)

You earned income from:

- Salary

- Freelancing

- Business or profession

- Capital gains (stocks, crypto, property)

- Bank interest / FD interest

- Rental income

Mandatory ITR filing cases (even if income < ₹2.5L):

- Deposited more than ₹1 crore in a bank account

- Spent ₹2 lakh+ on foreign travel

- Spent ₹1 lakh+ on electricity

- Holding foreign assets

- Received income from crypto

- TDS was deducted

3. New ITR Filing Rules for FY 2025–26 (AY 2026–27)

New Tax Regime is default

But taxpayers can opt for Old Tax Regime.

Updated penalty structure

Late filing fees:

- ₹1000 if income < ₹5 lakh

- ₹5000 if income > ₹5 lakh

AIS & TIS must match

Your ITR is auto-verified using:

- AIS (Annual Information Statement)

- TIS (Taxpayer Information Summary)

Any mismatch may cause scrutiny.

Mandatory disclosure

- Foreign assets

- Crypto/Virtual Digital Assets

- High-value spending

4. Documents Required to File ITR in 2026

Prepare these before filing:

For Salaried Individuals

- Form 16

- Salary slips

- AIS & TIS

- Bank statements

- 26AS

- Investment proofs (LIC, ELSS, PF, etc.)

- Home loan statement

For Business / Freelancers

- Profit & Loss statement

- Balance sheet

- GST returns

- TDS certificates

For Capital Gains

- Mutual fund statements

- Share trading report

- Property sale/purchase details

5. Types of ITR Forms (2026)

ITR-1 (Sahaj):

For salaried individuals with income up to ₹50L.

ITR-2:

For capital gains, house property, foreign income.

ITR-3:

For business & professional income.

ITR-4:

For presumptive taxation under sections 44AD/44ADA.

ITR-5, ITR-6, ITR-7:

For firms, LLPs, companies, trusts.

Choosing the correct form is important, or your ITR may get rejected.

6. Step-by-Step Guide to File ITR Online in 2026

Follow these steps on the official Income Tax portal:

Step 1 — Visit the Income Tax Portal

Click on Login using your PAN and password.

Step 2 — Check your AIS, TIS & Form 26AS

Navigate to:

- e-File → Income Tax Returns → View AIS

- e-File → Form 26AS

Ensure all income is reflected correctly.

Step 3 — Choose the correct ITR form

Individuals usually select:

- ITR-1

- ITR-2

- ITR-3 (if business income)

- ITR-4 (presumptive)

Step 4 — Start Filing Your ITR

Go to:

e-File → Income Tax Returns → File ITR

You will be asked:

- Assessment year: AY 2026–27

- Mode: Online

Step 5 — Select Your Income Sources

You must enter:

- Salary income

- Business income

- Capital gains

- Interest income

- Rental income

The portal pre-fills data from AIS/TIS.

Step 6 — Claim Deductions

Under Chapter VI-A, you can claim:

- Section 80C → ₹1.5L

- Section 80D → Health insurance

- Section 80G → Donations

- Section 80E → Education loan

- Section 80CCD(1B) → NPS ₹50,000

- Home loan interest deduction

Step 7 — Check Tax Calculation

Portal computes:

- Total income

- Payable tax

- Refund (if any)

Step 8 — Pay Tax (if required)

If tax remains unpaid, you must pay online.

Step 9 — Submit ITR

After review, submit your return.

Step 10 — Verify Your ITR

ITR is incomplete until verified.

Verification methods:

- Aadhaar OTP

- Net banking

- Bank account EVC

- DSC (for companies)

Your ITR is only considered filed after verification.

7. Common Mistakes to Avoid While Filing ITR

- Choosing the wrong ITR form

- Not reporting interest income

- Incorrect tax regime selection

- Mismatch between AIS and self-declared income

- Not reporting capital gains

- Missing home loan/HRA details

- Filing after due date

- Entering wrong bank details

A mismatch can cause:

✔ Scrutiny notice

✔ Delay in refund

✔ Penalties

8. ITR Filing Due Dates for 2026

For FY 2025–26 (AY 2026–27):

| Category | Due Date |

|---|---|

| Salaried Individuals | 31 July 2026 |

| Businesses requiring Audit | 31 October 2026 |

| Businesses requiring TP Report | 30 November 2026 |

Late filing penalty applies after due dates.

9. Benefits of Filing ITR Every Year

- Required for visa applications

- Required for bank loans

- Helps claim refunds

- Essential for high-value transactions

- Helps build a legal income record

- Avoids penalties & scrutiny

- Required for government tenders

10. Why File ITR with a CA?

A Chartered Accountant helps you:

- Choose correct ITR form

- Reduce tax legally

- Avoid notices or scrutiny

- Calculate capital gains accurately

- File business / GST-linked ITR

- Set off losses properly

- Claim correct deductions

Filing with a CA ensures:

✔ Accuracy

✔ Maximum refund

✔ Zero stress

Conclusion

Filing ITR in 2026 is easier than before, but choosing the correct form, matching AIS/TIS, and claiming all eligible deductions is crucial.

If you want professional support, NDM & Company offers:

- Expert ITR filing

- Tax planning

- Error-free submission

- Fast refund process

Contact us for CA-assisted ITR filing today!